How to Choose a Health Plan: Where to Start and What to Consider

How you get your healthcare, where, and how affordable it is for you largely depends on your health insurance. You want to choose a plan that works for you and your health needs, and for many, that opportunity to choose is here.

AZ Blue is here to help you navigate the Open Enrollment season. Read below for some useful guidance on where to start and what to consider when choosing a health plan.

And remember, it’s an important decision whether it’s for you or you and your family. Health insurance gives you access to care and treatment when you need it routinely or for emergencies, and it protects you from big medical bills.

How you get health insurance

How you get your coverage depends on your situation and what options are available to you.

If you already have insurance

Review your current health insurance plan to determine if it still meets your needs. Consider any changes in your or your family’s health, financial situation, or lifestyle that may require different health coverage.

If your employer offers health insurance

More than half of Americans get health insurance through their employer. If your employer offers health insurance, you won’t need to use the government insurance exchanges or marketplaces. For employer-sponsored insurance, the Open Enrollment window varies by employer. Many employers schedule Open Enrollment in the fall, so coverage can begin January 1. Check with your employer for exact dates.

If employer-sponsored health insurance is not an option

You can utilize the federal marketplace to get coverage. Arizona has a federally operated health insurance exchange, which means our state uses the HealthCare.gov website. The enrollment period for individual/family coverage runs from November 1 to January 15. You can also purchase health insurance through a private exchange or directly from an insurer during this period.

Compare the different types of plans

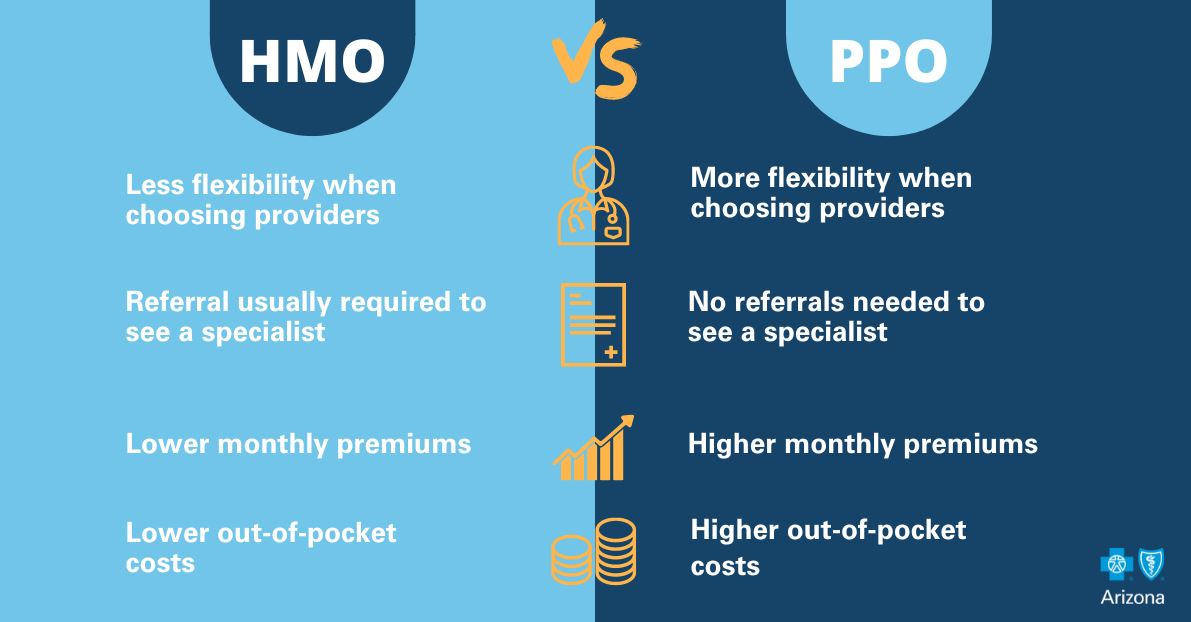

Expect to see some acronyms this enrollment season! Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and High Deductible Health Plans (HDHPs) aren’t the only types of plans, but they are among the most popular options.

The differences:

HMO plans usually have a lower monthly premium – and you can expect to pay less out of pocket. But, you have less flexibility when choosing providers.

PPOs typically have higher monthly premiums, but you get more flexibility when choosing providers and you won’t need a referral for any services. You might also pay more out-of-pocket with a PPO plan.

An HDHP has low premiums, but the high deductible part of HDHPs means you must pay more out of pocket until you meet that deductible. Employers often pair an HDHP with a Health Savings Account (HSA) to help you cover some, or all, of your deductible.

Understand out-of-pocket costs

In addition to your monthly premium, you may also have out-of-pocket costs such as a deductible, copays, and coinsurance. Make sure you understand these costs and how they impact your overall healthcare expenses and budget. Not sure what these terms mean? We break down the definitions here.

Is your doctor in-network?

If you already have a primary care provider or another doctor you prefer to see, check if they are in the health plan's network. Going to a doctor out-of-network will cost much more. Costs will be lower when you go to an in-network provider because insurance companies negotiate lower rates with in-network providers. If a health plan has a large network, that means more choices – making it easier for you to find doctors and medical offices close to you – and more affordable for you.

Research your health insurance policy

Once you’ve narrowed down a plan, research it and thoroughly review your “Summary of Benefits and Coverage.” If your health needs have changed or you anticipate needing additional services, check to see if your insurance will cover those services. Also, consider whether pharmacy is included. It is best to make sure during open enrollment that you have all the coverage you need, including coverage on the medications you’re taking.

And once your policy starts – make sure you’re taking full advantage of it! Most health plans must cover a set of preventive services like shots and screening tests. Some health insurance policies include incentives and perks in addition to the standard health insurance benefits they provide, like discounts on gym memberships.

There is so much to think about when choosing a health plan, even if you decide to stay with the policy you had last year. Don’t wait until the last minute to make this crucial decision for your health and well-being!